Interest in industrial premises is growing

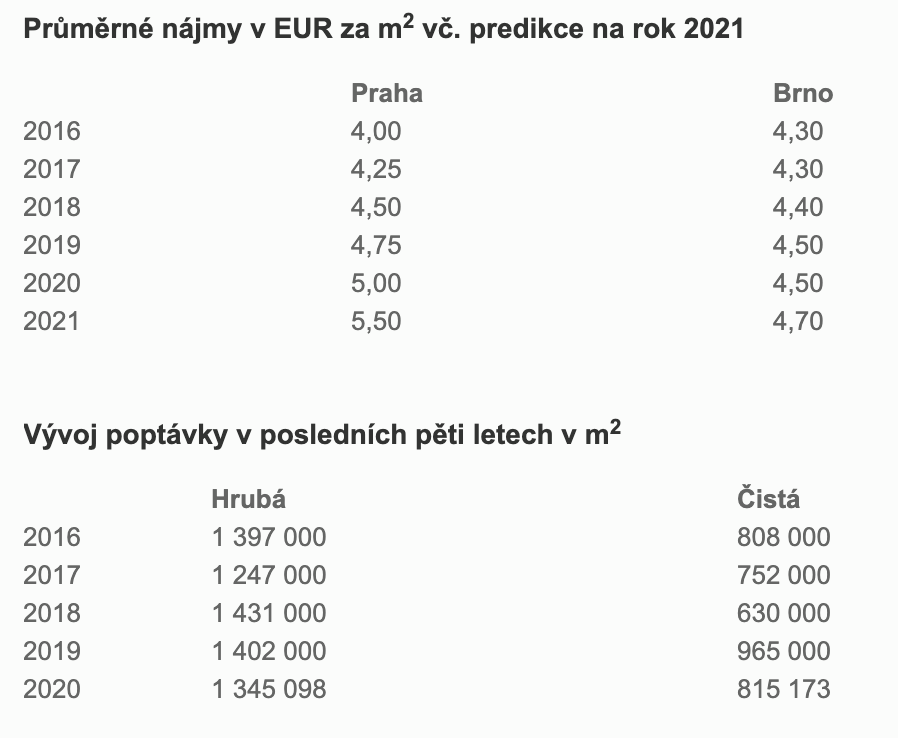

In the Czech Republic, there is a growing interest in industrial premises, production halls, and logistics centers. Gross demand during the fourth quarter of 2020 increased by 23% compared to the third quarter of 2020 to 409,082 m2. The situation is most evident in the vicinity of Prague and Brno and affects the growth of rental prices. "The growth in demand for industrial real estate is mainly related to the expansion of existing clients. The companies are aware of the quality of their locations and strive to provide room for development for the next years to come,” comments Jakub Holec, CEO of 108 Agency.

Due to the strong interest of companies in new or larger premises, the vacancy rate fell to 4.94% in the fourth quarter of 2020. Of this, 3% is the Moravian-Silesian Region and the Western Bohemia Region. At the same time, in Prague and Brno, the vacancy rate is below 2%.

The rise in rental and land prices

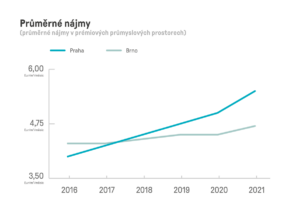

High demand and lack of supply of vacant industrial space will lead to higher rental prices. "We are still struggling with a shortage of land suitable for industrial development. Locations that were not previously considered lucrative are becoming in demand among investors. For example, in the Ostředek locality on the D1 motorway, 35 km from Prague, ten new halls with a total area of over 119,000 m2 are planned. We are sure that they will find their tenants in the next two years," says Jakub Holec.

He assumes that prices per m2 could increase by up to 10% in Prague and Brno: "In key localities, rental prices are already at EUR 5 per m2/month and we expect them to increase further," said Holec. With rents, land prices for industrial construction are also rising. In some localities in Prague, they reach the limit of 200 EUR per m2. The price of land is rising across Europe. For example, in Barcelona, the selling price of m2 is around EUR 350, in large German cities around EUR 300 and in Munich or Stuttgart above EUR 650 per m2 of land.

Leap in the investment segment thanks to coronavirus

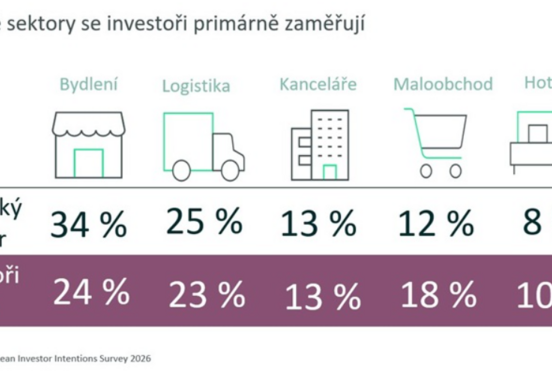

Yields are expected to decline in the investment segment. The premium yield of 5.25% no longer applies only to the Prague area. "Real estate is not losing value over time and will overcome inflation, warehouses have survived the financial and coronavirus crisis and have become a cornerstone of infrastructure. Yieldy will fall, the payback period of the investment will be extended, and real estate will become more expensive. Investors in industrial real estate believe and are willing to accept a reduction in yield for greater investment stability. Thanks to the pandemic, not only has the development of digitalization accelerated, but the goals will also move forward two to three years,” adds Jakub Holec.

Investors are increasingly focusing their originally allocated funds on offices and retail in the industrial sector. All indications are that due to the lack of investment opportunities in the industry, prices will rise and the stocks will fall.

New developers on the Czech market

Czechia is choosing more and more foreign developers for its operations. Last year, the German developer Garbe Industrial Real Estate entered the domestic market with the aim of offering premises to production, logistics, and e-commerce companies. As part of its expansion, the company has purchased a 65,000 m2 plot of land in Chomutov and is now planning further acquisitions. In 2021, for example, the Polish developer 7R, which is already actively looking for land for new acquisitions, plans to enter the Czech market.

In connection with the sale of 120 hectares of industrial land in western Bohemia, other important European industrial developers were also considering entering the Czech Republic. There are also extensive expansions, and GLP plans significant growth in the CEE region, both through acquisitions and in-house development.

Czech industrial real estate market for Q4 2020 in numbers

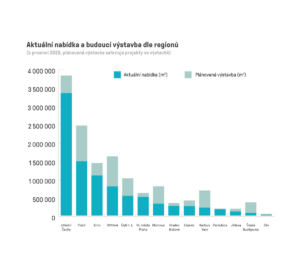

The total area of modern industrial space for rent in the Czech Republic reached 9.19 million square meters at the end of the fourth quarter. Of this, more than 3.28 million m2 is in the wider vicinity of Prague. 83,451 m2 of premium industrial space was completed. The total completed construction in 2020 reached 609,302 m2, which is the historically second-highest value in ten years. The record year was 2017 with 707,000 m2.

Source:// Systémy logistiky