“Due to the continued heightened uncertainty about further developments and the deteriorating economic outlook, some investors have taken a more cautious approach. In the second quarter, there were also no larger transactions above 100 million euros," states Lenka Šindelářová from the investment department of 108 Agency. Her analysis shows that in the second quarter, smaller transactions of up to 20 million euros prevailed. Nine of them were up to 10 million euros and six in the range of 10 to 20 million euros.

Among the most significant real estate transactions is the sale of the Tesco retail portfolio of the Adventum Penta fund - in the Czech Republic it involved four buildings. Then also the sale of the office building under construction Red Court in Prague's Karlín to BlackBird Real Estate. In addition to these larger transactions, several sales of smaller retail parks or warehouse and production spaces were realized.

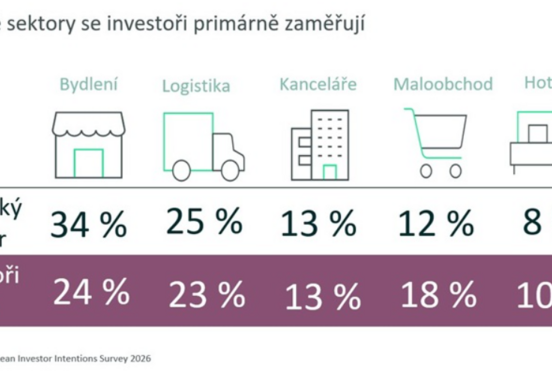

Among investors, Czech funds and real estate companies continue to dominate with a 53 percent share, followed by Slovak capital (18 percent representation). So it remains a constant that domestic market investors believe. The investment spectrum was dominated by retail real estate transactions (33 percent), followed by industrial/warehouse real estate (29 percent) and offices (26 percent).

"Despite the market decline, we still expect that this year's investment volume could exceed the two billion euro mark. In the second half of the year, some larger transactions, which are currently under negotiation, will probably be implemented. Yield rates remain stable for all types of real estate," adds Lenka Šindelářová.