The Czech commercial real estate market is undergoing major changes due to coronavirus. What are the current trends and what are the prospects for the office, retail or logistics and industrial real estate segment? According to CBRE's "Mid-Year Market Outlook 2021" analysis, a world leader in commercial real estate services, all of these sectors are showing signs of recovery. In the case of industrial real estate, this year will probably even go down in history as the year with the largest volume of demand on the domestic market. The good news is also that the volume of investments in commercial real estate in the Czech Republic is rising and the interest of international investors remains strong. In addition, the multifamily sector is becoming more and more popular: rental housing products are now among the most sought-after investments in the commercial real estate market in the Czech Republic.

The volume of investments in Czech commercial real estate reached approximately EUR 803 million in the first half of 2021, which is a decrease of approximately 55% compared to the same period last year. However, the volume of investments in 2020 includes the sale of Round Hill Capital's residential portfolio to Heimstaden Bostad for approximately EUR 1.3 billion, which was a very unique and unique transaction on the domestic market. Without it, last year's total investment would have fallen to about 560 million euros - and in this comparison, the values of this year's first half would have already exceeded last year's, which is a year-on-year increase of 43%. We have witnessed a reassessment of investors' strategies, repeated renegotiations of deferred transactions and also the cautious launch of new ones, which can now be seen in the growing volume of closed transactions. The interest of international investors in Czech assets remains strong. The domestic market is established as stable, in high demand - and so far there is no indication that this should change. There is enough capital in the market to respond to different opportunities (so there is no specific focus on just one type of asset, although the pandemic has caused many investors to strengthen their preferences for industrial and logistics real estate). However, investors evaluate very carefully factors such as income sustainability, vacancy or incentives. Among this year's trends, it is worth mentioning the reduction in revenues in the industrial and logistics segment, which is not a surprise, but rather a logical expectation in line with the situation in Europe.

Industrial real estate: a record year is expected

"The industrial real estate market has been very active since the beginning of 2021. Therefore, it is likely that this year will be a record year in terms of newly realized demand. In recent months, however, developers have been facing a complicated situation on the construction market, which brings uncertainty especially to new construction and results in extended delivery times and increased costs, which are slowly beginning to be reflected in rental conditions, "points out Jan Hřivnacký, head of industrial real estate leasing. in CBRE.

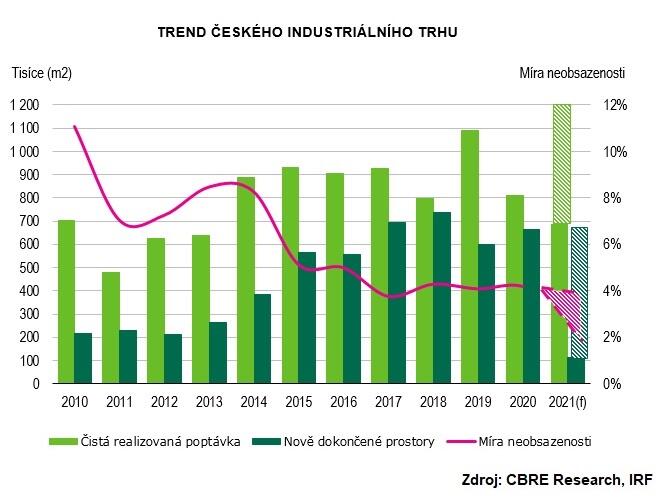

In the first half of 2021, almost 690,000 m2 was newly leased, which is only 14% less than for the whole of 2020 (788,800 m2). A comparison of this year's first half of the year with the same period of the strongest year so far (2019) shows an increase in demand of 35% and 60% in terms of total leasing activity. The CBRE forecast predicts that the second half of 2021 will be similar to the first half of the year, as the last quarter is usually the strongest in the year. The main driver of demand in the first half of 2021 were distribution companies mainly from the e-commerce sector (33%), which was accelerated by the pandemic. They were followed by companies focused on the production and logistics of third parties (3PL) with 32%, respectively. 29% share of demand. The typical length of lease for logistics companies remains 5 years, while for production companies it is 7-10 years. And flexibility is coming to the fore: while logistics operators consider short-term leasing to be the most important option, the top priority for manufacturers and retailers is to be able to use temporary storage capacity.

Most of the premises currently under construction are located on the outskirts of Prague, Pilsen and the Moravian-Silesian Region. The share of speculative construction decreased significantly from 30% in the 4th quarter of 2020 to 23% at the end of the 2nd quarter of 2021. CBRE assumes that this year the volume of new construction will remain similar to 2020 (ie 700,000 - 800,000 m2 of new space). The overall vacancy rate is currently only 3% and CBRE does not expect a change next year. Many tenants will need expansion to keep pace with the growing demand for their products or services. The situation is extreme in Prague, where the vacancy rate during 2020 ranged between 1-2%, which did not change during the first half of 2021. According to CBRE, rental prices should not change dramatically this year. The pressure to increase it may arise in the most desirable localities with a low vacancy rate - especially in Prague, where the monthly rent in premium localities rose from 4.90 EUR / m2 in the 4th quarter of 2020 to 5.10 EUR / m2 in the 1st quarter of 2021 and increased again in the second quarter of 2021 to 5.30 euros / m2.