Navigating the Recalibration: A Tenant's Market?

The Czech industrial real estate market, as revealed by Colliers' Q2 2025 survey, is in a clear phase of recalibration. While the market hasn't fully recovered from last year's downturn, marked by a 34% drop in gross realised demand below the five-year average, this shift is creating a more favourable environment for businesses looking for industrial space.

Rising Vacancy and Robust Construction Pipeline

For prospective tenants, the most significant positive development is the increase in the vacancy rate. In Q2 2025, the vacancy rate rose to 4%, encompassing over 511,000 sqm of available space – a 1.3 percentage point year-on-year increase. Crucially, when considering projects currently under construction, the volume of available warehouse space nearly doubles. More than 55% of the record 1.7 million sqm currently under construction across 171 logistics parks is vacant, offering substantial options for businesses.

Despite a low volume of newly completed space in Q2 2025 (131,600 sqm), the sheer volume of ongoing construction highlights the market's long-term development pace. While some completion dates might be postponed to 2026 due to the current lower demand, the vast pipeline ensures a steady supply of modern industrial facilities in the coming quarters.

Rental Trends and Enhanced Tenant Leverage

The highest achievable rent (prime rent) on the Czech industrial market has remained stable for four consecutive quarters at €7.00-7.50/month/sqm, making it the highest in the Central and Eastern European (CEE) region. However, this stability masks an important shift: tenants are increasingly gaining leverage. In areas that have seen significant development in recent years, such as Plzeň and the Moravian-Silesian Region, a slow downward correction in rents is already beginning to take shape. This offers opportunities for businesses to secure more favourable lease terms.

Key Construction Hubs and Sectoral Demand

A significant portion of the ongoing industrial construction is concentrated in strategically important regions. Prague and the Central Bohemian Region lead with 26% of new developments, followed by the Moravian-Silesian Region (19%) and the Karlovy Vary Region (18%). The latter's high share is notably driven by a single, large automated warehouse project in Cheb exceeding 200,000 sqm.

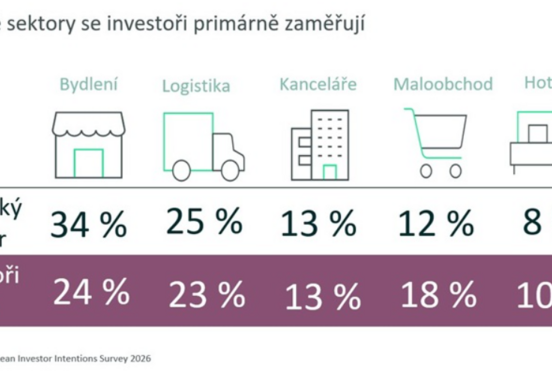

In terms of tenant composition, the logistics sector dominated gross realised demand in the first half of 2025, accounting for 62% of the total volume, largely due to a major renegotiation. Manufacturers represented 23%, and distributors 6%, indicating diverse demand across the industrial spectrum.

Challenges and Regional Competition

While the Czech economy continues to grow, the industrial market faces specific challenges that contribute to its recalibration. Lengthy building permit processes, a less flexible and more expensive workforce, and other administrative hurdles are noted obstacles. These factors are influencing some investors and tenants, particularly from the APAC region, to explore nearshoring options and expand their European activities in countries like Poland, Hungary, and Serbia, which often offer more aggressive government incentives and a simpler business environment.

Source: property-forum.eu