CEE Market Buzz: A Hotspot for Real Estate Investment

Investors in Central and Eastern Europe (CEE) are demonstrating significantly higher activity compared to their Western European counterparts. This heightened engagement is fueled by a notable willingness to sell properties and a greater appetite for risk, signaling a period of dynamic portfolio rebalancing across the region.

Jakub Stanislav, Head of Hotel Investments CEE and Head of Investment Properties at CBRE Czech Republic, notes, “The CEE region is entering a phase of significantly increased real estate turnover in investment portfolios. Investors here show greater courage and are prepared to actively regroup their assets. This trend signals that the CEE market offers interesting opportunities for those seeking higher returns through property appreciation.”

Evolving Sector Preferences: What This Means for Your Space Search

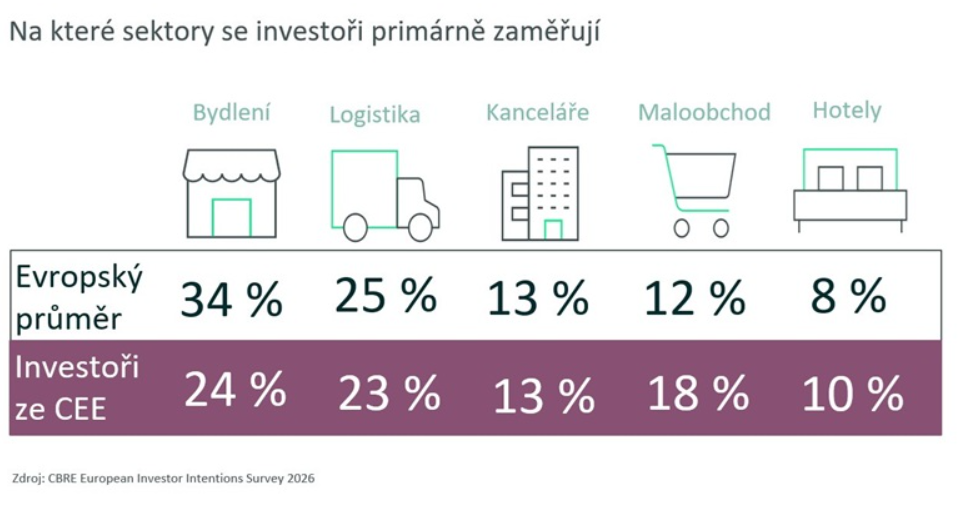

The investment landscape in CEE is undergoing a significant transformation in sector priorities. While offices dominated in 2022, investor interest has shifted. However, this rebalancing can present unique opportunities for businesses seeking office space, as investors focused on modernization or repurposing may bring newly upgraded, more attractive inventory to the market.

Logistics and warehousing properties, while no longer the single dominant sector, maintain a stable and substantial share of investor interest, settling at around 25%. This consistent focus ensures that the logistics sector continues to see investment in efficiency and modernity, crucial for businesses relying on robust supply chains.

Other sectors like residential (rental housing, student campuses), retail, and hotels are gaining traction, potentially freeing up older assets for repurposing or driving innovative mixed-use developments that could include commercial components.

Value-Add Strategy: Modernized Spaces Are Coming Your Way

A key trend among CEE investors is their preference for enhancing property value through modernization and change of use. A remarkable 41% of CEE investors adopt this approach, compared to a 37% European average. This strategic focus means businesses can anticipate a greater availability of renovated, upgraded, and more efficient commercial spaces designed for contemporary needs.

Investors are actively seeking higher yields through property enhancement, rather than solely pursuing stable, low-risk, premium assets. This drive for value creation translates directly into better quality and more adaptable spaces for tenants.

Sustainability at the Forefront: Green Buildings for Greener Business

Sustainability has become a critical factor in CEE real estate. Regional investors place even greater emphasis on energy and ecological improvements for existing buildings (67% compared to 63% for the European average). They are also more likely to demand discounts for properties that don’t meet sufficient ecological standards.

This strong focus on ESG (Environmental, Social, Governance) factors, often viewed through the lens of risk mitigation and cost-effectiveness, is excellent news for businesses. It increases the likelihood of finding energy-efficient offices and warehouses, which can significantly reduce operational costs, enhance corporate image, and help achieve sustainability goals.

Key Business Hubs: Warsaw and Prague Shine Bright

In the ranking of Europe's most attractive cities for cross-border investment, Warsaw has solidified its third-place position, a historic high. The Polish capital now ranks among the absolute top destinations, behind only London and Madrid, and has surpassed cities like Barcelona, Milan, and even traditional Western European hubs like Paris.

Jakub Stanislav highlights: “Warsaw benefits from stable macroeconomic fundamentals, strong demand across sectors, and favorable property prices. For investors, it represents a combination of liquidity, growth potential, and the ability to diversify risk outside saturated Western European markets.”

Meanwhile, Prague maintains a strong position on the regional investment map, closely following Warsaw. The Czech market is characterized by stability, transparency, and a developed investment environment, confirming its status as one of the most attractive investment destinations on the global stage. These leading CEE cities offer robust environments for establishing or expanding operations, providing access to growth potential and strategic market positioning for your business.

Conclusion: Seize Your Opportunity in CEE

The dynamic shifts in the CEE commercial real estate market, driven by proactive investors and a strong focus on modernization and sustainability, present a compelling landscape for businesses. Whether you're seeking cutting-edge office space in a thriving urban hub or efficient warehousing to optimize your logistics, the CEE region offers a wealth of evolving opportunities designed for future-proof business growth.

Source: systemylogistiky.cz